The effect of greenhouse gas emissions and green innovation on corporate investors’ financial performance toward net zero emissions

Abstract: The aim of this study is to provide investors, policymakers, and others with information on how greenhouse gas (GHG) emissions and green innovation affect corporate financial performance. This research presents the first detailed analysis of the impact of GHG emission reduction on corporate venture capital (CVC) investments in the US over 18 years, between 2002 and 2019. The study considers the three scopes of GHG emissions by CVC firms. Additionally, patents, citations, and weighted citations are analysed to present an in-depth discussion of the impact of green innovation by CVC firms on their financial outcomes. Moreover, this paper analyses environmental, social, and corporate governance (ESG) factors as a framework designed to be embedded into an organization's strategy that considers the needs and ways in which to generate value for all organizational stakeholders. These findings contribute to the ongoing debate on corporations’ role in reaching net-zero emissions and in building sustainable competitive advantage. We found that there is a positive moderating effect of social and environmental performance scores on the effect of both environmental performance and green innovation on corporate investors' financial performance. Moreover, the results show the isolated and combined effects of GHG emission reduction and green innovation on the financial performance of CVC firms. The results indicate that emission reductions give firms a financial advantage over time and that corporate investors are interested in driving green innovation. Furthermore, the results investigate the mediating role of social and environmental performance scores on CVC firms' environmental and financial performance. The results outlined in this paper have important implications for research and practice and illustrate the importance for corporate investors of including ecological considerations in their overall business strategies to create a competitive advantage.

Overlooked Effect of Negative Data on Efficiency Analysis

Prof. Qian Long Kweh - Abstract - Data envelopment analysis is approach that measures efficiency by assuming all inputs and outputs are treated as non-negative. However, financial data, such as net income and growth rate, is possible to have positive and non-positive values. The common techniques include data transformation and adding a constant. This column shares a unique example of addressing non-positive output data through data envelopment analysis. This study attempts to close the gap by revising the negative output according to the production scale. That is, the study applies a unique method in which the constant value is multiplied by the input based on the production scale. With this method, we are able to identify the most efficient decision-making units, considering that the constant value-added method ignores the effect of production scale. Keywords: negative data, data envelopment analysis, production scale. - Short Bio - Qian Long Kweh is a professor at the Faculty of Management of Canadian University in Dubai, United Arab Emirates. He is a qualified academic having over 14 years of experience and passion into teaching and empirical research. He has had articles published in ISI- indexed journals with wide readership like European Journal of Operational Research, OMEGA, The International Journal of Management Sciences, Journal of Knowledge Management, Journal of Intellectual Capital, Journal of Operational Research Society, Applied Economics, International Review of Financial Analysis, Research in International Business and Finance.

Volatility Interruptions, Idiosyncratic Volatility, and the COVID-19 Pandemic

Abstract -The objective of this paper is to examine the impact of adopting the static and dynamic volatility interruption market-model on the idiosyncratic volatility in Nasdaq Stockholm. We also examine the effectiveness of implementing such a market-model during the COVID-19 pandemic. Using the EGARCH model to estimate the idiosyncratic volatility (CIV), we find that the CIV increases as stock prices hit the upper static or dynamic volatility interruption limits. Conversely, we find that the CIV decreases as stock prices reach the lower static or dynamic volatility interruption limit. We also find that the CIV is higher when stock prices reach the upper static limit compared to the upper dynamic limit. To test the volatility spillovers hypothesis, we set a range of a two-day window after limit hit events and find no evidence for volatility spill-over one or two days after the limit hit event, indicating that the static and dynamic volatility interruption rule is effective in curbing CIV. Finally, we examine the effectiveness of the static and dynamic volatility interruptions during the COVID-19 pandemic and find that the CIV is lower during the pandemic as opposed to after the Pandemic, indicating that the market model helped stabilise the market during the pandemic. Keywords: Static and dynamic volatility interruptions, Idiosyncratic volatility, EGARCH model, COVID-19 pandemic, Nasdaq Stockholm

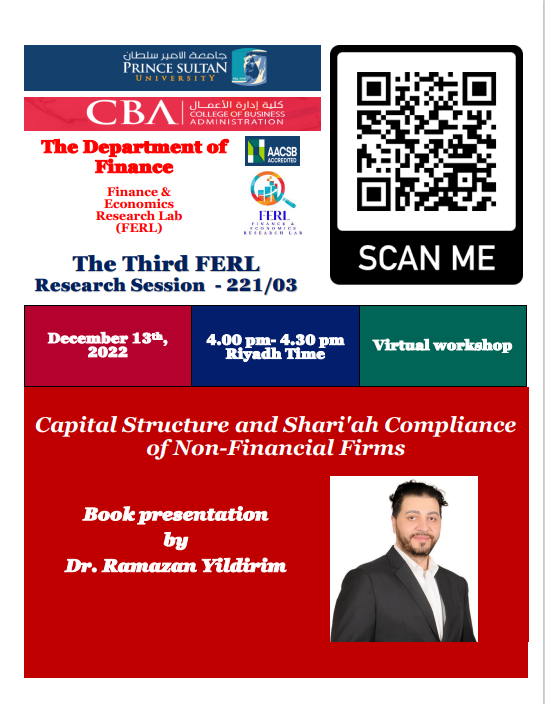

Capital Structure and Shari'ah Compliance of Non-Financial Firms

Abstract -Many Muslim individuals and institutional investors seek to invest only in stocks compliant with the Shari'ah (i.e., Islamic law). Among others, Dow Jones addressed this demand and has developed its proprietary screening methodologies to identify Shari'ah-compliant (SC) firms. One key factor distinguishing SC firms from their non-compliant peers (SNC) is that the former is not allowed to cross the leverage threshold of 33%. Due to the restrictions imposed on them, it is expected that SC firms exhibit different financing behaviour (capital structure) compared to the SNC firms. The obtained conflicting results suggest critical questioning of the methodology currently applied to identify SC firms. "Thinking Out-of-the-Box"; strong evidence from Islamic sources reveal that the most righteous and fair judgment is provided when endogenous factors are considered. RIEM (Ramy Islamic Equity Market) methodology and an Islamic Pecking Order Models are proposed, allowing companies to preserve a capital structure that supports and adheres to the main notion of Islamic finance and economics. Keywords: Capital Structure, Shari'ah Compliance, Non-Financial Firms, RIEM (Ramy Islamic Equity Market) methodology, Islamic Pecking Order Model.

Herding behaviour in ESG stock index: Evidence from Emerging markets

Abstract -This paper studies the herding behaviour of Environmental, Social and Governance (EGS) stock indices in the emerging market based on IMF emerging market criteria. We use daily data as a sample. Cross-sectional absolute deviation (CSAD) is employed to identify the herding behaviour of investors. The findings report that all the indices do not exhibit herding behaviour, even under the upward and downward episodes of the market. When oil price and implied volatility are included in the model, the herding only exists in some samples, such as Egypt and India during the upward of oil price fluctuation and implied volatility, respectively. Meanwhile, Brazil, China and Taiwan also show evidence of herding behaviour during downward oil price fluctuations. It is due to the large size of companies with solid governance nom included in the indices, and the information on the companies is widely available. It gives the implication that the investors do not rely on others in the investment decision. Keywords: herding behaviour, emerging markets, EGS, investors, oil, implied volatility.

The nexus between executive compensation and performance: Case of Islamic Banks

Abstract- The purpose of this study is to investigate the nexus between executive compensation and performance in Islamic banks (IBs). The relationship was examined through the direct effect of performance and the joint effect of performance and governance on pay. The study used static and dynamic panel regressions. These models are applied to determine the impact of performance on executive compensation using two different approaches: traditional and dynamic. The generalized method of moments (GMM) model was employed to avoid endogeneity biases in the regression estimation. Econometric models use different performance measures. (accounting and market-based measures). Results support a dynamic relationship between pay and performance. Executive pay in Islamic banks depends mainly on ROE as a performance measure. The results reveal that independent directors on the board perform a monitoring task, which lessens their reliance on pay to mitigate agency problems. This study confirms the hypothesis that larger IBs and those with high growth opportunities hire talented executives with higher compensation packages. This study provides the first comprehensive empirical study on the pay-performance relationship in Islamic banks through cross-country analysis. These findings contribute to a better understanding of the dynamic connectedness between pay and performance by incorporating the moderating effect of governance. Keywords: compensation, performance, corporate governance, Islamic bank, GMM

Enabling an Inclusive and Innovative FinTech Industry: The Talent Challenge

Short Bio- Amira Kaddour- is an associate professor at the National School of Sciences and Advanced Technologies - Carthage University, Chair of a Professional Master’s program: Innovation Engineering and Technology Transfer, assisted by the World Intellectual Property Organization. She has a PhD in Finance and certification in FinTech and inclusion from Luxembourg university – ADA chair for inclusive finance. Dr Kaddour is the scientific coordinator of ELITE innovation College– Cambridge UK for Africa and MENA region, president of Tunisian knowledge chapter of the International Society for Knowledge Organization – ISKO-MAGHREB,– Tunisia, and member of the executive board of the African Women in FinTech and Payment. She has contributed to the steering committee of several conferences and projects, focusing on the inclusive economy and outlooks of green transition and digital transformation https://octa2022.loria.fr/ . She has numerous papers focusing on behavioural finance, climate finance, digital transformation, and a green transition, in addition to inclusion, gender equality and technology transfer. Dr Kaddour is an editor of books focusing on gender equality, digital transformation, and multidisciplinary approach in scientific research for sustainable development. She has contributed to different projects toward efficient implementation of SDGs and